401k contribution calculator per paycheck

The amount of catch-up contribution is 6500 for 2022. For 2021 the maximum contribution for this.

401k Contribution Impact On Take Home Pay Tpc 401 K

Personal Investor Profile Download.

. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and. 401 k Contribution Calculator.

This California 401k calculator helps you plan for the future. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. This calculator has been updated to.

About Your Savings Enter what you have currently saved how much you could put in a monthly contribution to a 401 k and how much your employerthe business owner may. Catch-up contributions are treated the same way as any other. For example lets assume your employer.

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo. If you increase your contribution to 10 you will contribute 10000. Please note that your 401k plan contributions may be limited to less than 80 of your income.

Your employer needs to offer a 401k plan. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Your 401k plan account might be your best tool for creating a secure retirement.

You only pay taxes on. This calculator is provided only as a general self-help tool. Calculator This calculator helps you determine the specific dollar amount to be deducted each pay period.

You want to save for retirement and take advantage of your employers match in your 401 k plan but you arent sure you can afford to. We encourage you to talk to an. 100 Employer match 1000.

Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Simply know the number of salary payments you have left for the. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

This is the maximum percent of your salary matched by your employer regardless of the amount you decide to contribute. You may now make an additional pre-tax contribution to your plan. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Use this calculator to see how increasing your contributions to a. The accuracy or applicability of the tools results to your circumstances is not guaranteed. If your company matches your contributions dollar-for-dollar up to.

Check with your plan administrator for details. So lets say you contribute 7 of every paycheck to your 401k which works out to be 200 per paycheck.

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

How To Enter Your Paycheck Into The Retirement Budget Calculator Retirement Budget Calculator

How Much Can I Contribute To My Self Employed 401k Plan

401 K Calculator Paycheck Tools National Payroll Week

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

401k Contribution Impact On Take Home Pay Tpc 401 K

Download 401k Calculator Excel Template Exceldatapro

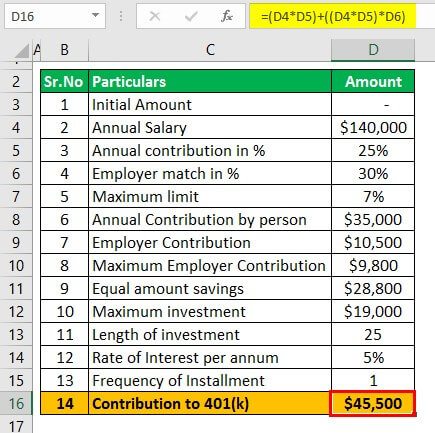

401k Contribution Calculator Step By Step Guide With Examples

401k Contribution Calculator Step By Step Guide With Examples

The Maximum 401k Contribution Limit Financial Samurai

What Is A 401 K Match Onplane Financial Advisors

401k Calculator

Solo 401k Contribution Limits And Types

Doing The Math On Your 401 K Match Sep 29 2000

How Much Should I Have Saved In My 401k By Age